When it comes to saving, Acorns is one of the favourite apps in the industry to invest in spare change.

If you’re like me, always looking for ways to make extra money. The Acorns Investing app is a great way to earn and invest cash passively. Try the Acorns App today, and get $5 FREE when you sign up.

I’ve tried different ways to make money, and my favourite ones involve those where I don’t have to do much work.

“Disclaimer” No app will make you a millionaire, but it’s hard to turn down free money!

Let’s check out the Acorns app and see how you can make money with it.

How to Make Money with Acorns App

Acorns is the easiest way to invest your spare change, and it lives up to its claim. Using this app, you can automatically round up your purchases and invest the difference.

The app is easy to use and perfect for beginning investors, and with these tips, you can easily add an extra $500 or more to your investment account every year!

Read on to learn strategies to maximize your earnings.

1. Automate Your Savings

This is the time of automation. Making small investments over a longer period is difficult; chances are you will forget it most of the time.

While most people know about the round-up feature of the Acorns app. You can also automatically transfer money on a fixed day of the month or take it from your paycheck.

This is a great way to put saving money first and move it out of your account before you have a chance to spend it.

For investing, half the battle is psychology and discipline. With automated investing, you offload the discipline to the app, so you don’t have to think about it!

Plus, you will not even notice a small amount of deductions from your bank account.

Set up automatic transfers, so you don’t have to think about it. Save more money every year. Try the Acorns app today and get a FREE $5 Bonus

2. Boost up Your Round-Ups

The Acorns app automatically rounds up the difference and deposits it into your investment account when you make purchases.

For example, if you buy a cup of coffee for $4.60, Acorns will round up to $5.00 and add $0.40 to your investment account.

If you choose, you can boost your round-ups to higher numbers. Instead of saving $0.40 with your $4.60 cup of coffee, you could save up to $5.00.

This is a great way to supercharge your investing and add money to your account more quickly.

Automatically round up your purchases and put the difference in your investment account. If you have 100 transactions a month at $0.50 each, that’s an extra $50/month or $600/year!

3. Earn Up to 10% Bonus Investments with Acorns Spend

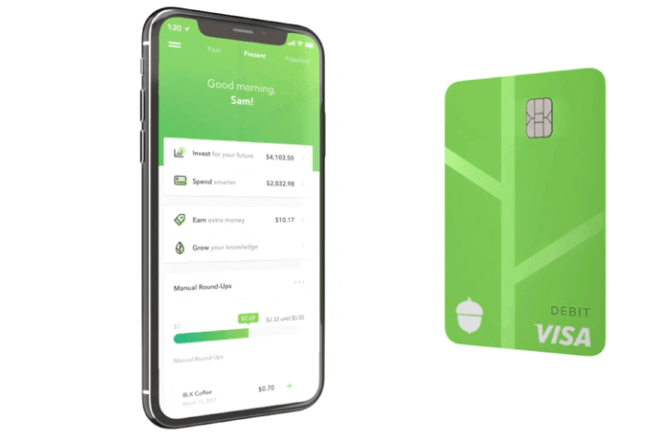

Acorns Spend is an all-digital banking system with direct deposit, a debit card, mobile check deposit, and more. It’s just like having a bank account, except made for the 21st century.

You can get a 10% bonus deposited in your investment account just by using your Acorns debit card.

Similar to Found Money, when you use your debit card to make purchases at certain retailers, you can get up to 10% bonus cash back deposited into your investment account.

Make even more money by using the Acorns Spend debit card for your purchases and get up to a 10% bonus investment in your account.

4. Cashback from Acorns App

Like other cashback apps like Rakuten or Drop, Acorns gives you cashback for shopping and deposits it directly into your investment account.

Shopping includes at brands that you probably shop at regularly, such as:

- Wal-Mart

- Apple

- Kohl’s

- Home Depot

- Walgreens etc.

This is truly free money and is a great way to earn extra money without any effort!

If you can get an average of 2% cash back on $10,000 of purchase per year, that’s a free $200 with no work!

5. Refer Your Friends and Make Extra Money

Once you are a member, you can get a referral link to share with others. If they sign up for Acorns, you’ll each get $5.

Acorns also run special promotions from time to time that increases your referral rewards.

If you like the app, share it with friends and family to make an extra $5-10 per sign-up.

Try the Acorns app today and get a FREE $5 Bonus

Want to Earn More, Try These Resources:

Make Money with Acorns – Conclusion

We all want to grow our investment portfolio, but setting money aside monthly can be challenging. Fortunately, with the rise of roboadvisors and investment apps, saving money is a lot easier than it used to be.

The Acorns App, in particular, is one of my favourites, both for the ability to automate your savings AND make extra money simultaneously.

With the tips above, you can easily earn and invest an extra $500 a year (at least!)

And right now, for a limited time, you can get an extra $5 just for signing up for an Acorns account. If your saving and investing game could use a boost, now’s the time to make a move!

Try the Acorns app today and get a FREE $5 Bonus

If you are planning to start a new blog or running a blog but still not making any money, here is my step by step guide for starting a blog. I will show you everything you need to generate a passive source of income.

Check out all the best resources I use! These resources have helped me immensely in my journey and I am sure they will help you as well.

Sumeet is a Certified Financial Education Instructor℠ (CFEI®) and founder of MoneyFromSideHustle. He is an experienced side hustler who replaced his full-time income with side hustles. His work has been quoted on major finance websites like CNBC, Yahoo! Finance, GOBankingRates, MSN, Nasdaq, AOL, and more. He has helped thousands of people find side hustles and is here to help you find your extra source of income. More about him.