If you want to make money for a long time learning to invest is the key. Learn how to invest and make money daily for beginners.

Ever noticed how your hard-earned money in the bank seems to just… vanish? Not literally, of course, but when you account for inflation, what you had last year buys less today.

It’s like trying to fill a leaking bucket.

But what if I told you there’s a way to plug that leak and even start filling the bucket faster?

If you have money in the bank, it decreases in value every day. Interest banks pay you are never more than inflation. So, in reality, if you are keeping money in a bank, you are getting negative returns. Here in this piece, I will tell you how to invest and make money daily online from it, which will beat inflation.

Investing isn’t just for the Wall Street wizards; it’s for anyone looking to make their money work for them and secure a better future.

Risk Management

Speaking of ups and downs, risk management is your safety net.

There are various ways to invest money, with few safer than others. But the safer it is, the lesser the returns. You need to make a balanced portfolio according to your age and your expected returns.

Your portfolio ideally should not be concentrated on one type of instrument. For example, if you are highly invested in stock markets, a major crash can wipe you out financially. That’s why mixing things up with bonds, real estate, or even art can help balance things out.

And always have an exit plan, like setting limits on how much you’re willing to lose on a bad investment.

As they say, don’t put all your eggs in a single basket. So here we will go through different ways you can use to diversify your investments. You will learn how to invest money to make money fast.

Let’s go through ways to invest and earn daily profit.

How to Invest and Make Money Daily For Beginners

Once invested, your money will make passive returns for you with daily profits. Some days will be positive while some days will be negative.

But if you follow the theory of diversification then you can get profits daily from your overall investments.

1. Invest on Real Estate

Let’s start with the oldest yet latest way of investing. Real estate investments have been there from old times as a great way to invest money for good and stable returns.

Now it has become even easier. No need to look for properties, do all the extra work to do the inquiries and so much more. It was a difficult job and therefore only a few people who have resources and knowledge were able to invest in real estate.

With the advent of the internet and apps thereafter, now you can invest in real estate with a single click. Fundrise is the best company in this space where you can start investing with as little as $500.

You have to just register and invest money, everything will be done by the company. A team of experts buys real properties with the money you and other people have deposited with them.

They do all the work and keep the commission for it. Other profits are passed on to investors like you. Their fees are very low and returns are high. This one is a must-have instrument in your portfolio for diversification.

Actionable Tip: Before diving in, spend some time on Fundrise’s educational resources to understand which type of real estate investment trusts (REITs) aligns with your financial goals.

Consider starting small and gradually increasing your investment as you become more comfortable with the platform.

2. Invest Your Spare Change for Long time Daily Returns

What if I tell you that you can make a fortune out of spare change! Not fortune literally, but you can make a few hundred to thousand dollars by investing the spare change every day.

Acorns is the app for you to save spare change and make investments with that. This is a Robo company that saves a few cents or dollars every time you spend money.

For example, you shop for a coffee of 2.50 dollars, Acorns will automatically round off it to 3 dollars and invest spare 50 cents in the portfolio you have already selected while registering with the app.

You can make changes to how much rounding off is done. It seems like a small amount at first but with time this money grows.

There are few others ways you can make money with acorns that are discussed in this article.

Actionable Tip: Set a goal for your spare change investments with Acorns. It could be for an emergency fund, a vacation, or even starting a small business.

Watching your goal get closer with each purchase makes saving more rewarding.

3. Start Investing in Stock Markets With as Low as $5

Stocks are a must for everyone’s portfolio. For long-term growth, stocks provide the necessary fuel to your investment portfolio.

You have not started investing in stocks because are worried that you don’t have enough cash. Now you don’t need tons of cash to start investing in stocks.

Even if a company’s share price is $100, you can buy a fraction of it. This is possible will new-age platforms or Robo investment apps such as Stash.

With Stash, you can start investing with even $5. When you join them, they even give you an extra $5 to invest *.

Even if you don’t have knowledge about stocks, you can just define the risk profile and your expected returns. Stash will automatically invest for you with minimal fees based on the plan you choose.

Actionable Tip: Use Stash’s educational resources to learn about different stocks and ETFs. Pick a theme or sector you’re passionate about to make investing more interesting and personal.

This approach keeps you engaged and invested in the performance of your picks.

4. Invest and Make Money Daily Online with M1 Finance

Another great option for investing in stocks is M1 Finance. Like Stash, it is also automated.

You get the option to choose stocks yourself or you can invest in funds already created by experts.

M1 Finance basic account is free to use for starters. You can invest in index funds as well if you don’t know about any stocks.

Actionable Tip: Take advantage of M1 Finance’s pie investment strategy to customize your portfolio. Allocate percentages to different assets based on your risk tolerance and financial goals.

Review and adjust your pie every quarter to keep your investments aligned with your goals.

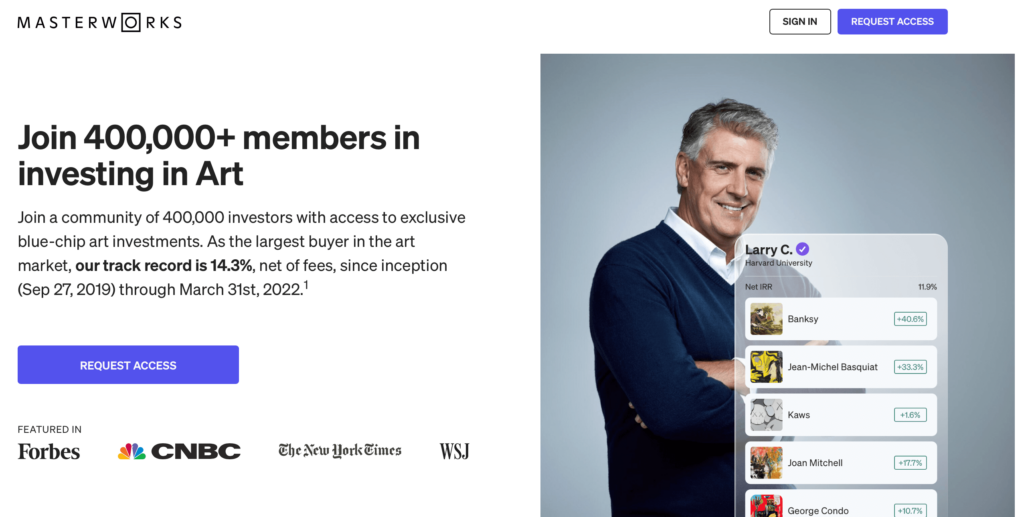

5. Invest in Art with Masterworks

How to invest and make money daily for beginners and yet portfolio keep your portfolio diversified? One great and unconventional way is by investing in the arts.

Artwork by famous artists increase in value every year and historically arts value has appreciated 14% annually for the last 14 years data.

This is the kind of investment that was not available for the common man because these art forms sell for millions of dollars.

But now with the help of Masterworks, you can invest with few thousand dollars in these million buck arts.

Your money is invested in an art piece and you are allotted shares of that art along with other investors. These artworks are acquired and maintained by Masterworks and are sold after there is an appreciation in the price.

They take a commission for all this work and profit is passed on to the shareholders. You can even trade your share to others in the open market before art is sold if you need money, but currently, liquidity is not that great.

There is currently high demand, so after requesting an invitation, they will take a basic interview to assess how much you will be allowed to invest.

Actionable Tip: After joining Masterworks, participate in webinars and read their market analysis to better understand the art market trends. This knowledge will help you make more informed decisions about which artworks to invest in.

6. Invest for Dividend and Make Money Daily

You can make money with stocks with minimal risk by investing in stocks that pay dividends.

These are the highly reputed companies that have huge profits and they have already passed expansion phases. They share profits with the stockholders in form of dividends.

On your part, you need to do your research about companies that pay handsome dividends year after year. Make a list of these companies and invest in them for the long term.

These companies pay dividends annually or quarterly. In addition to dividends as bonuses if you invest in good companies you will also get value appreciation in form of share price increase.

Start investing in dividend-paying shares with M1 Finance now.

Actionable Tip: Use dividend reinvestment plans (DRIPs) to automatically reinvest the dividends you earn into more shares of the dividend-paying stock. This compounding effect can significantly increase your investment returns over time.

7. Day Trade Stocks for Daily Profit

How to invest and make money daily with stocks? Try day trading.

Before going further I would say from my own experiences that this is a very risky strategy.

You can earn profits daily that are huge. But if you stray from your rules, you can lose all your capital. You should only go into day trading if you have control over your emotions and follow rules set by you.

First, start with small capital and take out the profits and grow your investments slowly.

If you follow these simple things and make rational decisions you can make money daily by investing in stocks.

Start day trading by opening M1 Finance account.

Actionable Tip: Start with a virtual trading account to practice day trading without risking real money. Many platforms offer simulation trading that mirrors live markets, which is a great way to hone your strategy and discipline.

8. Wealthsimple For Canadians

For people in Canada who want to use apps similar to Stash, there is Canada based company, Wealthsimple that provides similar services.

They automate your investments and they also have the option of investing spare change.

You have to choose the risk levels and Wealthsimple will make a portfolio for you with stocks across the market. Based on your needs you can choose different types of accounts.

The basic account is free of charge for beginners.

Actionable Tip: Take advantage of Wealthsimple’s financial planning sessions available to its users. Use these sessions to align your automated investments with your broader financial plan, ensuring your investment strategy supports your long-term goals.

9. Invest and Make Daily Money in Cryptocurrency

This is a highly speculative area of making money. There are so many fluctuations in the crypto markets that you can day trade and make money daily.

Currently, cryptocurrencies are hot in the new generation, after the success of Bitcoin many cryptocurrencies such as dogecoin are making inroads.

You can also ride the wave and invest or day trade in cryptocurrencies to make daily profits if you have experience in day trading in stocks and can recognize trends.

Daily swings of more than 10% are very common, giving opportunities for huge gains regularly if you know the market.

Actionable Tip: Dedicate time each week to educate yourself on cryptocurrency market trends and technologies. Follow reputable crypto news sources and consider joining a community of crypto investors to exchange ideas and strategies.

Invest with Coinsmart in Canada and Europe!

Start investing in Crypto with Coinbase in the US and the rest of world!

10. Invest in Peer to Peer Lending for a Daily Profit

To further diversify your portfolio, you can venture into peer-to-peer lending where you can give loans to other people for higher interest rates.

You can enroll in platforms such as PeerStreet where you invest money. This money is further distributed as loans backed by real estate.

As these loans are paid back you receive your share of profit. This is a great way to get higher returns than your banks.

Actionable Tip: Diversify your investments across different loan types and risk levels on PeerStreet. This can help manage risk and increase the chances of consistent returns. Also, reinvest your earnings to compound your profits.

Extra Reading: How to make $200 Quickly!

11. Invest Money in Flipping Websites

You can flip websites for more money to earn daily profits.

There are many websites on sale on websites like Flippa that have the potential for great earnings.

If you have to rank a new website, it takes a lot of effort and time. So, if someone has already done the groundwork and the domain is aged, you can buy it.

You need to be sure that the website has more earning potential and with your skillset, you can improve it and sell it at a higher price.

Actionable Tip: Learn basic SEO and content marketing skills to increase the value of websites you invest in. Even small improvements in a website’s traffic and revenue can significantly increase its resale value.

Extra Reading: Make money by Flipping!

More Ways to Invest and Earn Daily Profit

Other than these ways there are more ways to invest and make money daily.

12. Government-Issued Fixed Securities

You can buy US government-issued fixed securities that pay higher interest rates than banks.

Though they don’t provide very high-interest rates, you can earn more than banks and they are relatively safer compared to stock markets.

You can buy these government-issued securities on the Treasury direct bond portal that is managed by the government.

There are various options with different interest rates. Generally, the period of investments is longer than few years.

Actionable Tip: Use Treasury Direct’s tools and calculators to compare different securities and find the best fit for your investment timeframe and goals. Consider laddering bonds to have them mature at different times for regular income.

13. Invest in A 401(K)

Funding an employe matched 401(k) is a great way to make money passively by investing.

Few companies offer up to 100% match. So basically you can just double your money. The only thing is this is a long-term investment and you can’t access these funds till retirement age, other than a few exceptions.

This money will be tax-free when you will get it, which is another bonus.

Actionable Tip: Maximize your employer’s match as it’s essentially free money. Also, periodically review your 401(k) allocations to ensure they’re aligned with your retirement goals, especially as you get closer to retirement age.

14. Invest in a Certificate of Deposit (CD)

Similar to government-issued bonds, you can also invest in certificates of deposits (CD).

They are the safe ways to grow your investments with government backing. You have a fixed duration CD, after which you will get your money.

The advantage of CD over bonds is that duration is lower compared to years, you can invest your money for short durations such as few months.

Actionable Tip: Shop around for the best CD rates across different financial institutions. Sometimes, online banks offer higher rates than traditional banks. Also, consider building a CD ladder for flexibility and steady income.

15. Start a Blog for Daily Earnings

If you are looking for ways on how to invest to make money daily, then blogging can be your best bet if you are also willing to put in some effort.

Because after the initial investment of few dollars on hosting plans such as Bluehost, there are no other major investments other than your effort and time.

If you are willing to put in few hours per week, after few months you will have daily income from your blog. Now I make $150-200 every day from this blog.

You should also start blogging as a side hustle at least. And it’s not that difficult, following these easy steps, you can start your own blog within few minutes.

Actionable Tip: Focus on a niche you’re passionate about to create content consistently. Use social media and SEO strategies to drive traffic to your blog. Consider monetizing through affiliate marketing, sponsored posts, and ad revenue as your audience grows.

16. Invest in Yourself

Best investments are those that you put in yourself. Invest in your health, learnings, and passions.

Keep on learning new things that interest you always and you will be making profits every day for the rest of your life.

The more skills you learn the more money you will earn daily.

Actionable Tip: Identify online courses or local workshops that can enhance your skills or hobbies. Set aside time each week for personal development, and don’t be afraid to invest in high-quality learning materials or experiences that can offer personal or professional growth.

Final Thoughts on How to Invest and Making Money Daily For Beginners

Everyone has different investment goals and thus they need different strategies. But everyone needs to diversify their investment portfolios.

Considering all these options available you can choose how to invest and make money daily online that suits your needs best.

Investing is for the long term to create your wealth, but can also generate income every day for short-term needs. Just make sure to do your research before investing your hard-earned money because few options may suit you better than others.

Integrate Investing In Overall Personal Finance Strategy

Imagine your financial life is a big, delicious pie. Each slice represents a different part of your financial strategy: investing, saving, budgeting, and managing debt.

To enjoy the whole pie, every piece needs to be in balance.

Investing is a critical slice, sure, but it’s not the only one. You’ve got to save money for those rainy days because surprises happen—cars break down, roofs leak, and jobs can disappear.

A healthy savings account means you’re ready for whatever life throws at you, without derailing your financial goals.

Budgeting is your recipe for the pie.

It tells you how much you have to spend on each slice. Without a budget, it’s easy to overspend on one area (like those daily gourmet coffees) and not have enough left for others (like your retirement savings).

Then there’s managing debt. Some debt might be necessary, like a mortgage for a home.

But high-interest debt, like credit card balances, eats into your pie like a hidden mold.

Paying off this kind of debt might not feel as exciting as investing in the next big thing, but it’s often the smarter choice. The interest you save can be much more than what you’d likely earn from investments in the same period.

Integrating all these slices—investing, saving, budgeting, and managing debt—creates a balanced financial pie.

When each part is managed well, you’re not just surviving; you’re thriving. It’s all about seeing the big picture and making choices that support your overall financial health.

Diversify Intelligently: You should diversify your investment portfolio to maximize the returns. But you should not put equal money in all instruments. For example, investing in artworks is still a new thing, but it has potential. So don’t put more money in it, start with minimal amounts and increase with your own experiences.

Check out all the best resources I use! These resources have helped me immensely in my journey and I am sure they will help you as well.

* Paid non-client endorsement. See Apple App Store and Google Play reviews. View important disclosures. Investment advisory services offered by Stash Investments LLC, an SEC-registered investment adviser.

Sumeet is founder of MoneyFromSideHustle and an experienced side hustler who replaced his full-time income with side hustles. His work has been quoted on major finance websites like CNBC, Yahoo! Finance, GOBankingRates, MSN, Nasdaq, AOL, and more. He has helped thousands of people find side hustles and is here to help you find your extra source of income. More about him.