If you’re searching for a flexible side hustle, Instacart could be an excellent fit. Instacart is a top choice among gig apps where you can grocery shop for others and earn extra cash. You can pick your hours and get your paycheck every week or day.

So, how much money can you really pocket working with Instacart? Your earnings aren’t set in stone; they depend on various things like the number of grocery orders you finish, the tips customers give you, and the costs associated with the job like mileage.

This leads to a frequent question many have: does Instacart track mileage for you?

Here’s the quick answer: NO, Instacart doesn’t keep tabs on your miles. But, it’s important to track your Instacart mileage, because Instacart miles can help you lower your tax bill and keep your expenses in check.

In this article, we’ll dive into why it’s important to track mileage for Instacart, how to do it the right way, and how to claim tax breaks for the miles you cover.

So, let’s dive in!

Does Instacart Track Mileage?

Instacart doesn’t automatically track all the miles you drive for tax purposes. Specifically, the app only calculates the Instacart miles from the grocery store to the customer’s address. It shows you an approximate distance for each order.

This means the miles you drive to get to the store or between different deliveries aren’t included. So, if you’re wondering, “Does Instacart track mileage for every part of my work?” the answer is no.

The Instacart app only focuses on the mileage from the store to the customer. So, it’s on you to figure out how to track mileage for Instacart for the other parts of your journey. These other miles, like the ones you drive from your home to the store or between stores, are also tax-deductible.

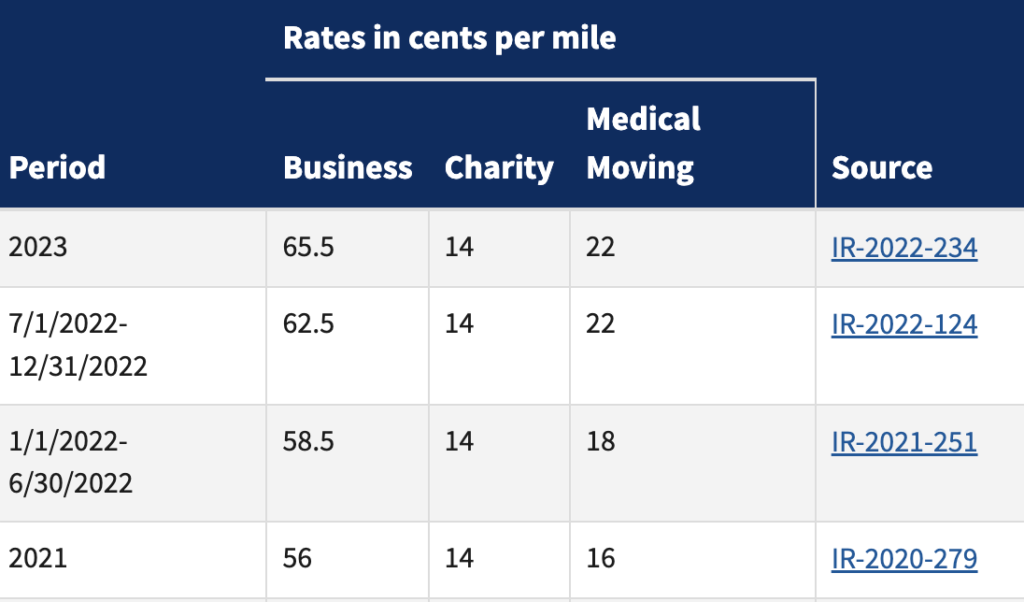

The IRS has a standard mileage rate for 2023, which is $0.655 per mile. This rate is what you can deduct from your taxable income for each mile driven for business activities. Keeping accurate records of your Instacart mileage can lead to significant tax savings at the end of the year.

So, if you’re doing Instacart, you’ll want to track your own mileage to reduce your taxes and make the Instacart hustle worth it.

Extra Reading: Does DoorDash Track Mileage?

Why Tracking Your Miles is Crucial When Doing Instacart

Why should you pay attention to the miles you rack up while doing Instacart shopping? Well, it boils down to two things: saving money on your taxes and being smart about how your car’s value decreases over time, also known as vehicle depreciation.

Money Back on Taxes

When you’re working as an Instacart shopper, you’re not an employee but an independent contractor. That means you have to tell the IRS how much you’ve made and spent so they can figure out how much you owe them in taxes.

One thing you can subtract from your total income, making it smaller for tax purposes, is the miles you’ve driven for Instacart.

The IRS has a set amount they count per mile, which was $0.655 for the year 2023.

Picture this: you drove 10,000 Instacart miles in 2023 and earned $20,000. If you don’t keep track of those miles, you’ll owe taxes on all $20,000. But if you’re smart and track your Instacart mileage, you can tell the IRS your income was actually $13,450 ($20,000 – $0.655 x 10,000 miles).

That means you have $6,550 less income they’ll tax you on, which could save you a bunch of cash.

However, don’t think you can just guess how many miles you drove.

You need to record everything, dates, times, where you went, and the purpose. Plus, you’ll need other stuff like gas receipts to prove you really did spend money on your car.

If you mess this up, not only will you lose out on tax breaks, but the IRS might even fine you if they decide to check your paperwork.

Like IvyGirlWV from Reddit said, “I track all mileage, including to and from the store back home after delivery. It’s all a business expense that I would not have incurred if I wasn’t doing Instacart.” IvyGirlWV makes a point: this isn’t just something optional. It’s a business expense that you wouldn’t have if you weren’t doing Instacart, so it’s wise to track it.

Your Car’s Decreasing Value

The second reason why it’s crucial to monitor your Instacart miles is because of vehicle depreciation. This is how much less your car is worth as it gets older and you use it more.

Think about it. If you drive a whole bunch for Instacart, your car will wear out faster and will be worth less when you try to sell it.

For example, let’s say you bought your car for $10,000 and after driving it 100,000 miles for Instacart, it’s worth only $5,000. You lost $5,000 in value right there. Plus, you probably spent more fixing the car, changing oil, and getting new tires compared to if you had driven it less.

So, tracking mileage doesn’t just help you for tax purposes; it also helps you understand how much you’re really making after you account for your car getting older and needing more repairs.

Knowing this might make you set some money aside for a new car or maybe decide to work different hours to make up for the loss.

In a nutshell, if you want to be smart about your Instacart side hustle, knowing how to track mileage for Instacart and actually doing it is key. It impacts how much money you get to keep, making it essential for every Instacart shopper out there.

Extra Reading: When Instacart Batches Start In The Morning?

How To Track Mileage For Instacart

Instacart doesn’t track mileage for you, so it’s all on you to keep tabs on those Instacart miles.

Wondering how to track mileage for Instacart? You’ve got several options to make sure you’re keeping accurate records for tax purposes.

Using Apps to Track Mileage

One of the most straightforward ways to do this is by using a smartphone app. Apps use GPS technology to keep track of where you go and how many miles you drive.

This is super helpful for keeping an eye on your Instacart mileage.

With a quick swipe, these apps let you label trips as either personal or for your Instacart work.

Some even allow you to track other work-related expenses, like gas, directly through the app. Most of these apps offer a free basic version, with the option to pay for more features if you need them.

Here are some of the top ones for you:

Everlance: Specifically designed for mileage tracking, Everlance uses GPS to automatically track your trips. Label your journeys as personal or business and even add notes or receipts. You can sync your bank and credit card info to monitor earnings and spending. The app lets you export your reports as PDF or CSV files.

Stride: Similar to Everlance, Stride automatically tracks Instacart miles using GPS. It also lets you log other expenses like fuel, tolls, parking, and more. Tax tips and savings estimates are additional perks. And, you can send your reports in PDF or CSV formats.

Hurdlr: This all-in-one app tracks your mileage, income, and expenses, and even estimates taxes. You can link it with different platforms like Instacart, Uber, Lyft, and so on. Real-time tax estimates and reminders are handy features. You can even file taxes straight from the app.

Waze: A popular navigation tool, Waze also does Instacart mileage for you. You can set it to start and stop mileage tracking automatically when you connect or disconnect your car’s Bluetooth. Plus, you can send mileage reports to your email or Google Drive.

Google Maps: This one’s a favorite for navigation but it also helps in Instacart mileage tracking. By tapping on your profile photo and picking “Your timeline,” you can review your daily trips and distances. You can edit these if necessary and even export your data to Google Drive or download it as a KML file.

Before moving on, here’s what some Instacart shoppers have to say:

Fantastic_Relief says: “I use Everlance.” delpaint says: “Just log your starting and ending mileage each day into an Excel spreadsheet, and it’ll do the math for you.” ball2000 says: “Everlance can track miles in the background.” Upstairs_Hand1929 says: “With Google Maps, you can calculate all the miles driven while working.” angelcake says: “I use MileIQ, and it makes categorizing and tracking business mileage super easy.”

As seen above, people have different methods for tracking mileage for Instacart and other gig apps. The key is to find what works best for you.

Tips for Instacart Mileage Tracking:

- Start and stop your chosen app when you begin or end an Instacart shift. This ensures you only track relevant miles.

- Keep your phone juiced up with a car charger to prevent battery drain or loss of signal while tracking Instacart miles.

- Regularly back up your data. Most apps allow you to sync or export your data to cloud services or email.

- Periodically review and adjust your recorded trips for accuracy. You might need to manually add or delete some entries if the app misses or duplicates them.

- Keep a paper log as a backup. A simple notebook can be a lifesaver if your app or phone fails you.

Sure, tracking your Instacart mileage might seem like a chore, but it pays off big time during tax season. Not only can you lower your taxes, but you also get a clearer picture of your earnings and car’s health.

So don’t let the absence of an Instacart mileage tracking feature hold you back. Pick an app from this list or find your own way to track those Instacart miles. When tax time rolls around, you’ll be glad you did.

Using Spreadsheets for Mileage

If you prefer doing things manually, a spreadsheet is another way to go.

You can use programs like Excel or Google Sheets to make a simple log of your Instacart miles.

You’d need columns for the date, time, destination, the reason for the trip, and the miles driven. You can also add some easy formulas to automatically tally up your totals, making it easy to see at a glance how much you’re driving for Instacart.

What Instacart Shoppers Say: “I just use a spreadsheet on Google Drive and update it every day with my start and end odometer readings.”

Pen and Paper Approach

Alternatively, you can go old-school with a paper logbook. Keep it in your car, and jot down the same type of info you’d put in a spreadsheet: date, time, destination, purpose, and miles driven for Instacart.

You can buy cheap printables on Amazon to help you with manual tracking.

No matter which method you pick, consistency is key.

Make sure to regularly update your records and keep track of your Instacart miles and other vehicle-related expenses like gas and repairs.

The IRS may want to see your records going back at least three years, so hang onto them.

So, whether you choose an app, a spreadsheet, or good old pen and paper, tracking your mileage for Instacart is an essential part of maximizing your earnings and minimizing your tax bill.

It’s something you’ll want to get into the habit of doing, as Instacart does not track mileage for you.

If you have questions or need more guidance, it’s always good to consult with a tax professional to make sure you’re doing everything by the book.

Extra Reading: How to Use Instacart Instant Cashout?

Tips to Track Mileage for Instacart

So, once you’ve tracked your miles, what then? Well, the IRS says for 2023 you can knock off 65.5 cents for every business mile you drive. But, what does Instacart consider as ‘business miles’?

You can count these:

- Miles from the moment you turn on the Instacart app till you turn it off.

- Driving to the store for your first job.

- Zooming between stores for multiple gigs.

- Hitting the road to the customer’s place.

- Driving back to a spot where you can get more jobs.

But don’t count any miles for personal stuff like errands or breaks.

To figure out your deductions, just take your business miles and multiply them by $0.655. Like, if you did 100 Instacart miles today, you could deduct $65.5 from what you owe in taxes.

Note: There’s another way, the ‘actual expense’ method. Here, you gotta keep tabs on everything your car needs, gas, repairs, insurance, and so on.

You’ll multiply those costs by the percentage of miles you drove for Instacart to get your deduction.

This one’s more work, but could save you more money in some cases.

Does Instacart Pays For Gas

Instacart doesn’t pay you separately for the miles you drive.

Instead, they factor in a small mileage reimbursement into the total amount they pay you for each batch of groceries you deliver.

They add a flat rate of $0.40 to batch payment for every batch order. It’s important to note that this $0.40 is a one-time addition to the whole batch payment and is not calculated per mile driven.

Unfortunately, when gas costs around $5 a gallon, this $0.40 barely makes a dent in your expenses, especially when you have to drive a considerable distance for most Instacart orders.

In short, you’re not fully compensated for the miles you put on your car while working for Instacart.

Extra Reading: How to Bypass Instacart Waitlist?

Other Ways To Save Money on Taxes as an Instacart Shopper?

Alongside tracking your mileage with Instacart, there are several other deductions you can claim to reduce your taxable income. Let’s dive into them:

- Phone Expenses: Since you need a smartphone to use the Instacart app and talk to customers, part of your phone bill can be claimed as a business expense. For example, if half of your phone use is for Instacart, then 50% of your bill can be deducted. Reddit User Comment: “I’ve found that it’s crucial to keep track of how much I use my phone for Instacart specifically. I was able to significantly lower my tax bill by doing this.”

- Insulated Courier Bags: To maintain the right temperature for hot and cold foods during your Instacart deliveries, you might use insulated bags or coolers. The cost of these items can be deducted as a business expense.

- Tolls and Parking Fees: Should you encounter any tolls or parking fees while driving for Instacart, these can also be claimed. However, if you’re already deducting the standard Instacart mileage rate, tolls, and parking fees are included in that and can’t be claimed separately.

- Roadside Assistance: If you have a plan or membership like AAA for emergency roadside help, part of that cost can be claimed as a business expense. You can use the same percentage as you do for your phone expenses to figure out your deduction.

- Insurance: Both your car and health insurance costs can be partially deducted. For car insurance, use the same percentage as your phone to calculate your deduction. For health insurance, you can deduct the premiums for you, your spouse, and your dependents, given you’re not eligible for any employer plan.

To make these claims, keep your receipts and records handy and report them in Schedule C of your tax return.

Ensure these are ordinary and essential for your Instacart work and that you haven’t been reimbursed for them by Instacart or anyone else.

Extra Reading: How to Get More Instacart Orders!

How to Make More Money as an Instacart Shopper

Besides understanding how to track mileage for Instacart and claiming these deductions, there are more ways to boost your income.

- Choose Your Batches Wisely: Instacart offers various batches, but they’re not all the same in terms of pay. Look for batches that pay at least $20 per hour, considering distance, number of items, and tip amount. Like this Reddit User Comment: “I used to accept anything, but now I only take batches that pay at least $1 per item or $1.00 per mile to ensure fair payment.”

- Speed and Efficiency: The quicker and more accurate you are, the more Instacart miles you can cover and the more batches you can complete. Know the stores, plan your routes, choose the best times to shop, and be quick yet careful in selecting items. Here is what a Quora user has to say: “To improve your speed, you need to know the layout of the stores. The faster you shop and deliver, the more batches you can do, meaning more money.”

- Be Personable and Communicate: Great service results in better ratings and more tips. Introduce yourself to the customer, send updates, and thank them. Always ask for feedback to improve.

- Adapt and Diversify: Stay updated with market trends and be open to working on other platforms like DoorDash or Uber Eats to maximize your earnings.

These tips and deductions can help you not just with your Instacart mileage but also to increase your overall income.

Always remember, the key to maximizing earnings is to be smart with your choices and keep track of your expenses and miles.

Final Thoughts on Instacart Mileage

Instacart doesn’t keep tabs on your miles. But just because Instacart doesn’t do it, doesn’t mean you should skip it too.

You can knock off some dollars from your taxable income by claiming mileage deductions. Tracking your mileage can also give you a good idea about the wear and tear happening to your car, helping you plan for future upkeep and fixes.

But, you can’t just say you drove those miles; you’ve got to prove it if there is demand from Uncle Sam.

You’ve got a couple of options to track mileage for Instacart. You could download a mileage tracking app on your phone or go old-school and keep a logbook in your glove compartment.

Either way, jot down the date, starting and ending odometer numbers, total Instacart miles for that trip, and why you hit the road.

In simple terms, keeping an eye on your Instacart mileage is not just smart; it’s money-smart. You’ll save on taxes, be ready for car repairs, and basically get more bang for your buck. So, don’t slack off; start tracking your mileage today.

More Earning Options:

- Games that pay money

- Best things to rent for cash

- Apps that pay to run in background

- Is Shein $750 gift card legit

Sumeet is founder of MoneyFromSideHustle and an experienced side hustler who replaced his full-time income with side hustles. His work has been quoted on major finance websites like CNBC, Yahoo! Finance, GOBankingRates, MSN, Nasdaq, AOL, and more. He has helped thousands of people find side hustles and is here to help you find your extra source of income. More about him.