If you’re a Dasher, or you’re thinking about becoming one, you might be interested in how to make more money and spend less while doing your deliveries. Dashers are independent workers who decide when they want to work, earning money based on the number of deliveries they complete and the tips they get.

One of the key things you’ll want to understand is how to track your mileage for DoorDash if you want to make DoorDash worth it. This means keeping an eye on the miles you drive while doing your deliveries.

DoorDash mileage can be a big factor when it comes to paying your taxes as is the case with other gig economy apps. If you know how to track Doordash miles, you can take those miles off your taxable income, which means you pay less in taxes.

You might wonder, “Does Doordash track your miles, or how do I do it myself?” There are different ways to keep track, including using apps to track mileage for DoorDash.

So, let’s get started!

Does DoorDash Track Mileage For Drivers?

If you’re driving for DoorDash, you might be asking, “Does DoorDash track my miles?” or “How can I track DoorDash mileage?”

Sadly, DoorDash does not track your exact mileage for you, but it can give a rough estimate. DoorDash only monitors the distance between the restaurant and the customer, not the total distance you drive, including getting to the restaurant, the distance between two deliveries, or completing multiple deliveries.

So, how to track mileage for Doordash? Since DoorDash doesn’t track miles for taxes, it’s your job to keep track of your DoorDash mileage.

You’ll need to accurately record every time you start and finish a delivery. You’ll also need to note the date, time, purpose, and destination of each trip.

If done manually, this can become pretty cumbersome and boring over time as it needs to be done daily. However, there are easier alternatives I will discuss later.

Note: If you are lazy or missed tracking your exact miles, you can use the estimate from DoorDash of the total miles driven. They send this information to all drivers near tax season and you can use it as a last resort but it will not be an actual representation of your total DoorDash miles as this is just the distance of order delivery.

Related: How much can you make with DoorDash in a week!

Why Is Mileage Tracking Important for DoorDash Drivers?

If you’re a DoorDash driver or considering how to track Doordash miles, understanding your mileage is crucial.

Why? Because driving is not just your job; it’s often your most significant expense.

Whether you drive for DoorDash, Uber Eats, or any other food delivery service, you must be clear on how to track mileage for tax and business purposes.

Extra Reading: Does DoorDash Refund Gas Money?

Tax implications for DoorDash drivers

One primary reason why tracking DoorDash mileage is essential is that it can save you money on taxes.

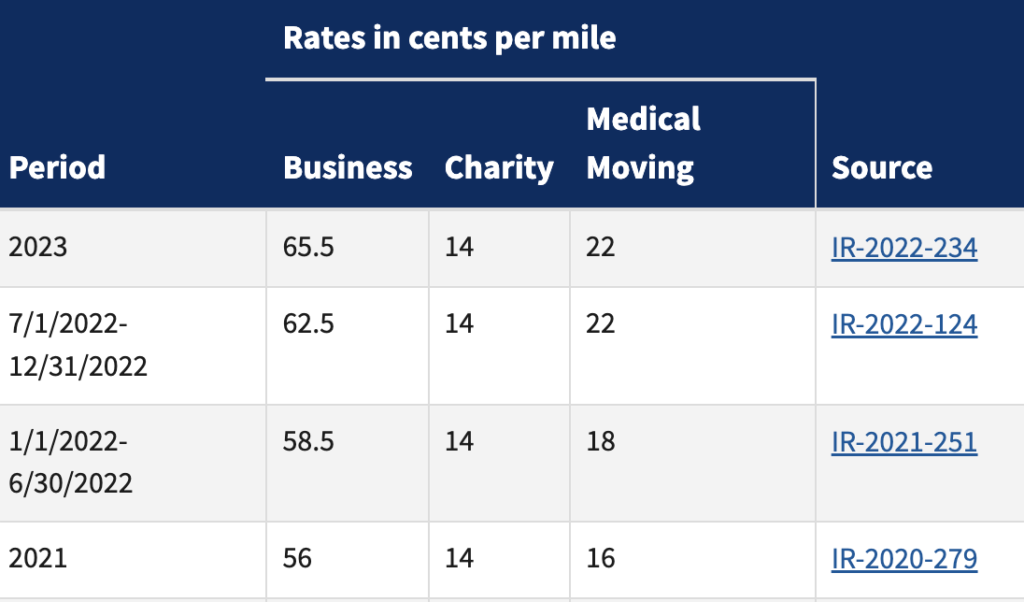

The IRS allows you to reduce your taxable income by 65.5 cents for each mile driven in 2023 for business purpose.

But DoorDash doesn’t track your miles. So it falls on you to understand how to track DoorDash mileage.

For example, if you drive 1,000 DoorDash miles in 2023, you can deduct $655 from your income. This could save you hundreds or thousands of dollars in taxes depending on how much time you spend on driving apps to earn money.

But to claim this deduction, you must have a reliable Doordash mileage tracker. You can’t just guess your mileage.

Instead, use the best mileage tracker for DoorDash or a simple method like a notebook. Keep records for at least three years after filing your tax return, showing the date, miles driven, destination, and purpose of each trip.

How DoorDash miles impact overall earnings

Another reason to know how to track Doordash miles is that it helps measure and increase your overall earnings.

Your Doordash miles affect not just your taxes but also fuel costs, vehicle maintenance, and more.

By tracking your mileage through the best app to track mileage for DoorDash or manually, you can track and optimize how much you are spending on gas per mile.

How to Track DoorDash Mileage Yourself

If you drive for DoorDash, you may be able to reduce your taxes by tracking your miles. But how to track DoorDash miles?

To do this, you’ll need to keep track of your mileage and have the right records for the IRS.

Using Apps to Track DoorDash Mileage

One of the simplest ways to track DoorDash miles is by using a DoorDash mileage tracker app on your phone.

Apps use GPS to track your location and distance, without you having to put in the information yourself. Some apps also let you track other costs like gas and maintenance.

Some can even send this information to your accountant or tax person.

But are there any downsides to using an app to track mileage for DoorDash?

Well, some apps might use up your battery or your data plan. Some might not be accurate if the GPS signal is weak, and others might have limited features unless you pay for an upgrade.

You might also find that some apps aren’t compatible with your phone or have bugs that affect how they work.

There are some great apps available that can help you:

- Everlance: This is a handy app that does more than track DoorDash miles; it automatically follows your mileage and expenses and can also generate reports. It’s like having a DoorDash mileage tracker right on your phone. Free option allows tracking of 30 automatic trips per month; Premium costs $8/month or $5/month annually for unlimited trips; Premium Plus is $12/month or $10/month annually, adding individual training and an account manager.

- Stride: This free app is perfect for those who want to know how to track mileage for DoorDash and find deductions to save money on taxes. It also keeps an eye on your income and expenses.

- Hurdlr: If you want a user-friendly DoorDash mileage tracker, look no further. Hurdlr tracks your mileage, income, expenses, and taxes, offering real-time insights and alerts.

- Gridwise: Specializing in rideshare and delivery drivers, Gridwise tracks your DoorDash mileage, earnings, and expenses. It’s like a community of drivers, and could be the best mileage tracker for DoorDash!

Any of these apps can be a great addition to your Dashing hustle. These apps can be used for other delivery jobs like Uber Eats and Instacart, so even multiapping won’t be a problem.

Extra Readings: Does Your DoorDash Acceptance Rate & Completion Rate Matters?

Using Manual Methods to Track Doordash Mileage

Another way to track Doordash mileage is by doing it yourself, like keeping a paper logbook in your car or using a computer spreadsheet.

You’d write down things like the date, where you went, and the odometer readings.

The benefit of tracking mileage manually is that it doesn’t cost much and you can make it just how you like it. It also means your information is private.

But this method of tracking DoorDash miles is slow and boring to write down every trip. Mistakes can happen easily, and keeping track of the paperwork can be hard.

You can buy a small notebook or pre-printed mileage tracker for a few dollars can can note down readings before starting the dash and at the end of the dash.

If you have missed tracking a few dashes, you can go into the DoorDash app and go to each delivery to find out the estimated distance and add them up for tracking purposes. Though this method is very tiresome, it can be used as a last resort.

Extra Reading: What to Do If Getting No Orders on DoorDash?

How to Calculate and Claim Mileage Deductions for DoorDash Miles?

Once you know how to track DoorDash miles, you’ll need to calculate and claim your mileage deductions on your tax return.

There are two main methods, either the standard mileage rate or the actual expense method, and we’ll explain both here.

- Standard Mileage Rate Method: This method calculates your Doordash mileage by multiplying your total annual business mileage by the IRS’s standard rate (65.5 cents per mile for 2023). It’s easy and might result in a higher deduction. The only thing you need is an app to track mileage for Doordash, like the ones mentioned above, and the purpose of each trip.

- Actual Expense Method: If you want to know how to get mileage from DoorDash more accurately, you can add up all the costs related to using your vehicle for business. This method may be more complicated but reflects the true cost of operating your vehicle.

If you’re self-employed, you’ll report your business income and expenses, including your Doordash mileage, on Schedule C.

But there are rules:

- You must be using your vehicle for business.

- You must keep records of your mileage, whether through an app to track mileage for Doordash or a diary.

- You cannot deduct commuting or personal miles.

- If your employer or another source reimburses you, only the excess amount can be deducted.

Extra Reading: Can You Make More Money With Earn By Time Mode?

Practical Tips and Advice

No matter how you choose to track DoorDash mileage, whether with the best mileage tracker for DoorDash or by hand, here are some useful tips:

- Track your mileage daily: This helps to make sure your records are right.

- Use maps as a backup: If you’re unsure of the distance, online maps like Google Maps or Apple Maps can help you check or estimate.

- Keep your records: Hold onto your DoorDash mileage records for at least three years in case the IRS needs to see them.

- Have a paper log in your car: It’s good to have a backup in case your technology fails.

- Review your records regularly: Look for mistakes or things that don’t match up, and fix them.

- Find what works for you: Whether it’s a DoorDash mileage estimator app or a paper logbook, pick what fits your budget and needs.

Whether using the best app to track mileage for DoorDash or manual methods, tracking your miles may seem like a chore, but it can save you money on taxes and help you keep track of your expenses.

By following these tips, you can make it easier on yourself.

Extra reading: DoorDash top Dasher requirements.

More Ways to Save Money for DoorDash Drivers

Besides figuring out your DoorDash miles, there are other ways to manage your DoorDash mileage effectively. Here are some of them:

- Plan your routes wisely: Before you hit the road, use a map or app to find the best routes for your DoorDash deliveries at the best delivery times. Steer clear of traffic, blocked roads, tolls, and more. By grouping deliveries and avoiding trouble spots, you’ll save time and gas.

- Use Cashback Apps: You can find cashback on your gas purchase. Even if you get 2%, you can save hundreds of dollars every month. For example, apps like GetUpside can show you nearby gas stations with offers on gas.

- Take care of your vehicle: Regular maintenance keeps your car running well, cuts down on fuel use, and saves on repair costs. Follow the best DoorDash driver tips like, tracking oil changes, tire pressure checks, brake checks, and more. Keeping a log of your maintenance helps too. If possible, try to drive a vehicle with better fuel efficiency, especially if you are signing up as a new driver and planning to buy one for delivery purposes.

- Use Dasher Discounts: DoorDash offers many rewards for their drivers. They partner with various companies to bring different products at discounts for the Dashers. For example, you can join DasherDirect to get faster payments and 2% cashback on gas. There are other offers like a 20% discount on the Everlance app, discounts on vehicle maintenance, and many other offers provided from time to time. It will be a good idea for drivers to check this page from time to time to save money.

- Drive safely and smoothly: Safe driving isn’t just about avoiding accidents; it’s also about saving gas. Follow the rules of the road, don’t speed, and avoid sudden stops or starts. Simple things like turning off unnecessary accessories that use power can save money.

Tracking your DoorDash miles and following these DoorDash tips to get more miles in your gas can really make a difference to your bottom line.

Extra Reading: How to make $500 in a week?

Final Words on DoorDash Mileage Tracking

Understanding and managing mileage as a DoorDash delivery driver is not just a matter of efficiency; it’s a vital aspect of your bottom line in this hustle.

By now you must be aware of the significance of accurate mileage tracking such for tax implications, and various tracking methods.

Whether you’re a seasoned driver or just starting, recognizing the importance of mileage tracking can make a significant difference in your earnings and tax deductions.

While DoorDash may not directly track mileage, the tools and insights provided in this article offer drivers the ability to take control of their mileage records.

Embrace these practices to enhance your delivery experience, save on taxes, and put more money in your pocket.

Related Reading:

- DoorDash memes to get your mood lighter

- How to skip DoorDash waitlist

- Is Rover worth it as a side gig

- Is $750 Shein gift card real or scam?

Sumeet is founder of MoneyFromSideHustle and an experienced side hustler who replaced his full-time income with side hustles. His work has been quoted on major finance websites like CNBC, Yahoo! Finance, GOBankingRates, MSN, Nasdaq, AOL, and more. He has helped thousands of people find side hustles and is here to help you find your extra source of income. More about him.